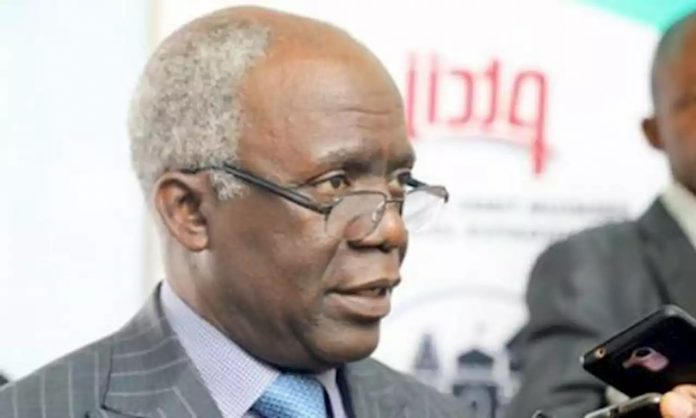

Femi Falana, human rights lawyer and Senior Advocate of Nigeria, has raised serious concerns over the country’s weak tax enforcement system, revealing that oil and gas companies owe Nigeria a staggering $6 billion in unpaid taxes.

Speaking on Wednesday during a paper presentation titled “Tax Law and Administration: Challenges of Compliance” at the ongoing 27th Annual Tax Conference of the Chartered Institute of Taxation of Nigeria (CITN) in Abuja, Falana criticised the federal government for allowing such massive revenue losses while continuing to borrow to fund national budgets.

He described the situation as evidence of poor financial accountability and called for greater transparency and representation in the country’s tax system.

The prominent human rights lawyer criticised the Nigerian tax system describing it as lacking the foundational principle of “taxation with representation.”

Speaking during a panel discussion on tax policy and public accountability, Falana said Nigeria’s approach to taxation is riddled with inefficiencies, opacity, and mismanagement that undermine public trust and discourage compliance.

Drawing historical parallels, Falana referenced the American and French revolutions, which were sparked in part by taxation without representation.

“In Nigeria, we cannot perform taxation without representation. If you want me to pay taxes, then why? Where is the representation, the justification, or the return to the people?”, he asked.

Falana lamented the proliferation of taxes in Nigeria, pointing out that some fiscal policies list as many as 60 different taxes, far beyond the original 25 outlined.

“No government needs 60 taxes,” he argued, describing the current framework as excessive and burdensome.

He also spotlighted glaring issues in revenue transparency and accountability, using Lagos State as an example, Falana claimed that taxes collected from buses and motorcycles alone amount to over N1.3 billion annually, yet there’s little clarity on how these funds are utilised.

Citing a September 2023 report, Falana revealed that oil and gas companies allegedly withheld $6 billion (about N64 billion) in taxes due to the government within a year.

“Shockingly, two months later, the federal government approached the National Assembly to borrow N2.1 billion to fund the national budget.

“How do you explain that? We’re losing billions to tax evasion, yet borrowing to survive,” he queried.

Falana also condemned the government’s silence over a COVID-19 era N3.4 billion loan allegedly used without due process.

“Nobody has challenged it,” he said, questioning how public funds are managed.

He stressed that taxes are meant to provide public services such as security, schools, hospitals but today, many Nigerians see no benefit from what they pay.

Also speaking on the panel, Rakiya Ahmed, Executive Chairman of the Zamfara State Internal Revenue Service, echoed similar concerns.

She noted that Nigeria’s historic reliance on oil revenue led to underdevelopment in tax systems.

“Because of our weak revenue from oil, we are now forced to focus on taxation,” she said.

Ahmed identified several structural challenges to tax compliance, noting key among them is the perception of corruption and a lack of transparency.

“When citizens do not see any return on their taxes, they’re less likely to comply,” she said, stressing the importance of a strong social contract between the government and taxpayers.

She also criticised the complexity of Nigeria’s tax laws, which she said discourages voluntary compliance.

“There are so many laws, and constant amendments confuse taxpayers,” she said.

Ahmed called for increased use of technology in tracking and enforcement.

She noted that Zamfara is one of the first states, after the FIRS, to deploy a data analytics system that revealed a supposed low-income taxpayer with hundreds of millions in their account.

This, she said, shows how data can help expand the tax net to include high-net-worth individuals who often escape scrutiny.

Ahmed highlighted taxpayer education as a major factor in boosting compliance, especially in rural areas.

“When taxpayers understand their obligations and see the benefits, they are more willing to comply,” she said.

She advocated for grassroots collaboration with traditional rulers, unions, and community leaders to enhance outreach and build trust.

The panelists agreed that while tax reforms are underway, the Nigerian government must address the trust deficit, simplify the tax code, use technology to track evaders, and, above all, demonstrate that tax revenues are used for the public good.

Without visible and accountable returns, they warned, compliance will remain elusive and public resentment will grow.