The Federal Government of Nigeria has announced its plans to issue a Eurobond, marking its return to the international bond market since its last issuance in March 2022.

For this venture, the government has enlisted the services of leading global investment banks, including Citibank NA, JPMorgan Chase & Co, and Goldman Sachs Group Inc., along with Standard Chartered Bank and the Lagos-based Chapel Hill Denham, as advisors.

According to Punch, the upcoming Eurobond issuance, expected to occur before June, represents a pivotal moment for Africa’s largest oil-producing nation as it seeks to re-engage with global financial markets.

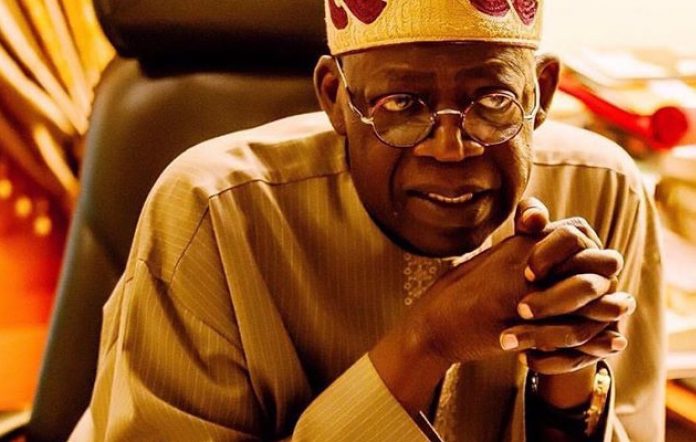

This initiative is part of a broader strategy to finance the significant budget deficit outlined in President Bola Tinubu‘s N28.8 trillion ($18 billion) spending plan for 2024, which projects a fiscal shortfall of N9.8 trillion, or 3.8 percent of the GDP.

The exact size of the Eurobond offer has yet to be determined.

However, sources close to the transaction, who preferred to remain anonymous, told the platform that Nigeria could aim to secure up to $1 billion in international loans throughout 2024.

This external financing is deemed critical for the country to manage its ambitious fiscal deficit. The shortfall is expected to be covered through a mix of local and international borrowings, alongside support from global financial institutions.

In a related development, Minister of Finance and Coordinating Minister of the Economy, Wale Edun, revealed that the decision to issue Eurobonds was influenced by the potential for lower interest rates and ongoing economic reforms.

Since taking office in May 2023, President Tinubu has introduced several policies to attract foreign investment and revitalise the economy.

These include two devaluations of the naira to establish a more flexible exchange rate regime and the controversial removal of fuel subsidies.

Furthermore, the Federal Government has disclosed plans to borrow N450 billion from its third FGN bond auction of 2024, a significant reduction from the N2.5 trillion target of the previous month.

According to the Debt Management Office (DMO), this auction will feature a new 3-year bond and the reopening of existing bonds, with the collective aim of financing the 2024 budget deficit.

With the DMO’s recent circular announcing the auction details, including the offer of three different bonds, each with an allocation of N150 billion, the government’s N450 billion borrowing target for March 2024 is set.